By: Kris Weninger

Weninger Mortgage Team Fairway Independent Mortgage Corporation – Beaver Dam , WI

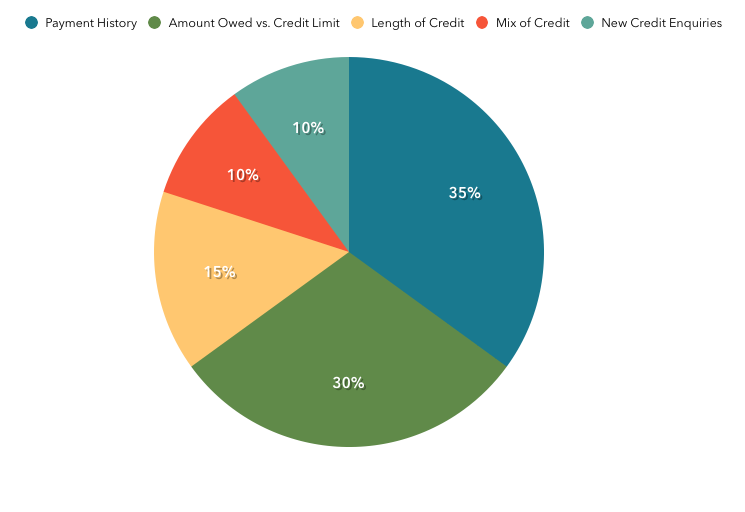

Nearly any time you apply for credit, the lender will check your credit score. So much has been advertised and written about credit scores that I thought it would be a great opportunity to discuss what goes into this important number. There are five major factors used to determine your score. Let’s review!

The 5 Factors that Determine Credit Score:

PAYMENT HISTORY – 35% The more often you pay your bills without exceeding the late period, the higher your Payment History score.

AMOUNT OWED VS CREDIT LIMIT – 30% The closer your current debt is to your credit limit the potential the lower scores you can have.

LENGTH OF CREDIT – 15% The longer you have active accounts, the higher the credit score.

MIX OF CREDIT – 10% A mix of different types of loans such as credit cards, car loans and student loans increases your credit score.

NEW CREDIT ENQUIRIES – 10% The more often you apply or look for new credit, the lower your credit score.

It is always good practice to review your credit score annually to make sure your accounts or Social Security Number have not been breached and to take any actions necessary to address any discrepancies.

Fairway Independent Mortgage Corporation (NMLS 2289).

Kristine Ann Weninger (NMLS#225608)

836 Park Ave, Beaver Dam, WI 53916

920-960-0852 kweninger@fairwaymc.com

Equal Opportunity Lender